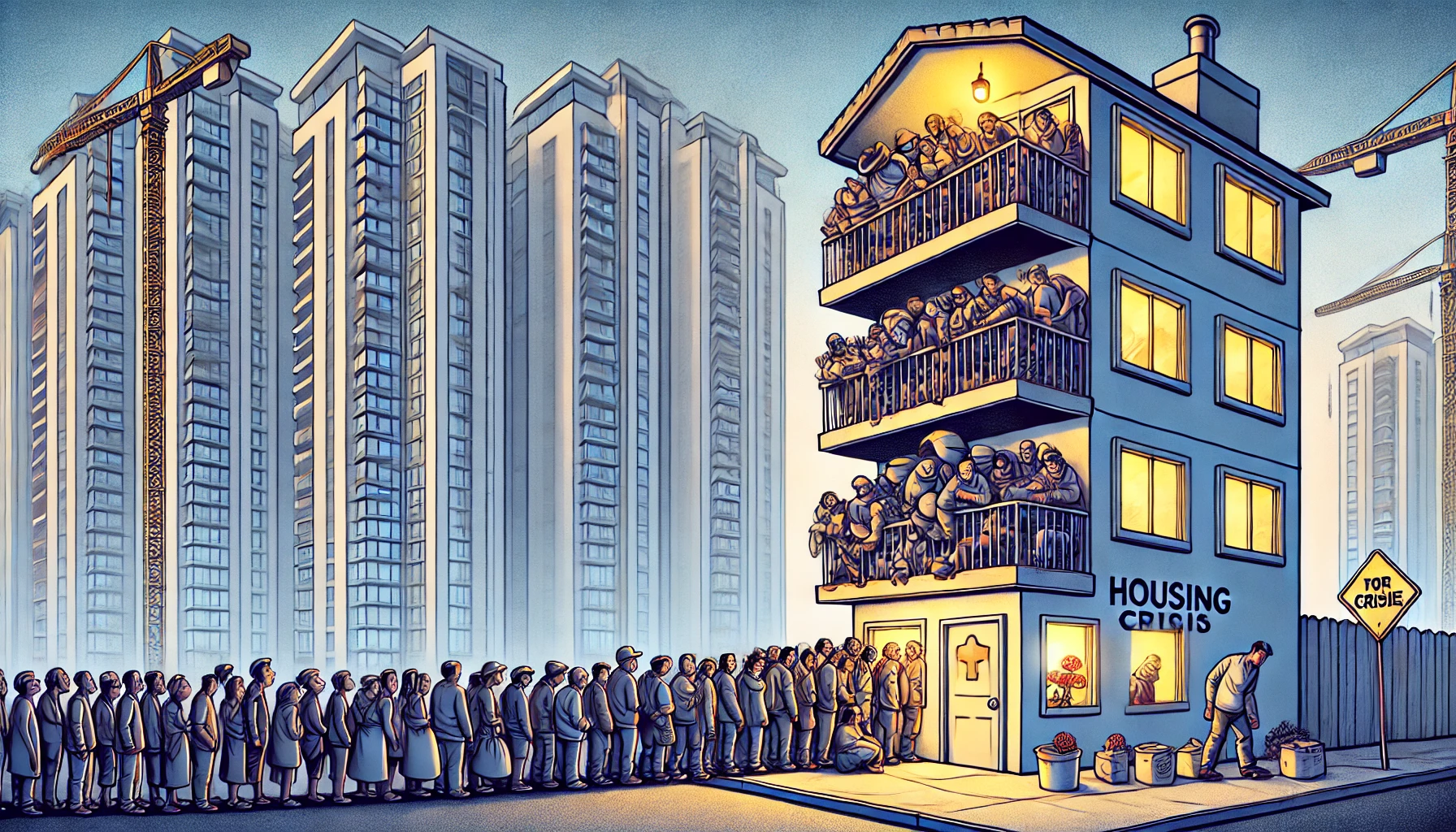

If you’ve ever tried to buy or rent a house in the past decade, you probably noticed something weird—everything is expensive. Not just kind of expensive, but insanely, mind-bogglingly, you-have-got-to-be-kidding-me expensive. And the deeper you dig, the more confusing it gets.

Governments throw policies at the problem. Developers build more houses. Economists analyze the data. Yet, for some reason, housing just keeps getting more unaffordable. Why? What the hell is happening? And most importantly—are we completely doomed, or is there a way out of this mess?

Welcome to the housing crisis. Let’s break it down.

What Even Is a Housing Crisis?

Housing is something that should follow the basic rules of supply and demand. More people need houses? Build more houses. Problem solved. Right? Wrong.

A housing crisis happens when a huge portion of the population can’t afford decent housing despite working full-time (or even multiple jobs). This problem exists in places as different as San Francisco, London, Tokyo, Sydney, and São Paulo. It’s not a one-country issue—it’s a global mess.

The Symptoms of the Crisis:

Soaring home prices

Once upon a time, buying a house was a reasonable thing that regular humans could do. You saved up, found a nice little place, and boom—you were a homeowner. But then, something happened. House prices went on an absolute bender, and wages? They stayed home, took a nap, and barely moved.

In the U.S., home prices have skyrocketed 290% since 1987, while wages have only crawled up by 15% (adjusted for inflation). Europe? Just as bad, if not worse. The Netherlands saw home prices balloon by 80% in the past decade, turning cities like Amsterdam into playgrounds for the ultra-wealthy while first-time buyers are left wondering if they should just live on a boat. Germany? 60% increase in housing prices since 2015. The UK? Over 70% rise since the early 2000s. Even places like France and Spain—where things were once relatively stable—have watched housing costs climb at breakneck speed, leaving affordability in the dust.

At this point, the concept of owning a home has become a mix of wishful thinking and financial wizardry, requiring a lottery win, a generous inheritance, or a miracle.

Outrageous rents

Monthly rents in major cities are devouring people’s salaries, leaving little room for savings, let alone luxuries. In cities like New York and San Francisco, the median rent for a one-bedroom apartment is over $3,000 per month, consuming more than 50% of the median household income. In London, rent for an average apartment has risen 25% in just the past two years, with many young professionals spending over 40% of their income on housing. In the Netherlands, the average rent in Amsterdam has increased by over 35% since 2015, with one-bedroom apartments often exceeding €2,000 per month. Across Europe, rent hikes are pushing people out of city centers, leading to longer commutes and worsening economic inequality. 3. Homelessness and housing insecurity – Imagine working full-time, doing everything “right,” and still not being able to afford a place to live. That’s the reality for millions.

Boomers vs. Millennials Conflict: The Great Housing Divide

Once upon a time, homeownership was like a rite of passage. You worked, you saved, you bought a house, and you probably even had money left over for furniture that didn’t come in a flat-pack. But then, something happened. That “something” is the reason Millennials stare at their Boomer parents’ home-buying stories like they’re hearing about an ancient civilization that somehow functioned without Wi-Fi.

In the UK, the average house price was 3.6 times the average salary in 1997. Sounds doable. Today? That number has exploded to 9.7 times the average salary. Which means if you’re a Millennial, you’d probably need to either win the lottery, invent the next world-changing technology, or resign yourself to renting indefinitely.

The story isn’t much better elsewhere. In the Netherlands, home prices have increased by over 80% in the past decade, with Amsterdam becoming an exclusive club where only the super-wealthy (or extremely lucky) can buy a home. First-time buyers are left competing for the rare affordable properties with investors and pension funds that buy homes like they’re Pokémon cards.

In the U.S., the median home price was about $120,000 in 1985. Adjusted for inflation, that would be around $340,000today. But the actual median price? $417,000—far outpacing income growth. The down payment alone can feel like a mythological beast Millennials have heard of but never seen.

In Germany, the homeownership rate is one of the lowest in Europe at around 46%, partly because prices have risen by 60% since 2015, making home-buying unattainable for many. Even in places like France and Spain, where homeownership was traditionally within reach, younger generations are finding it increasingly difficult to buy anything without serious family wealth.

The bottom line? Boomers got houses; Millennials got unaffordable rent, a housing market inflated beyond reason, and a deep-seated fear that they’ll be stuck in their overpriced apartment forever. Unless something changes, the dream of homeownership for younger generations might go the way of affordable college tuition—something that once existed but is now a relic of the past.

Homelessness is a huge problem

The UN estimates that 1.6 billion people worldwide lack adequate housing, with 150 million people experiencing homelessness. In the Netherlands, the numbers are just as grim. As of 2024, there are approximately 30,600 homeless individuals, up from 26,600 in 2022—a trend that’s flipped from a previous decline. Here’s a kicker: 20% of the homeless population are children. Let that sink in. One-third of adults experiencing homelessness are women, adding another layer of complexity to the crisis. And if you think you can just jump on a list and get social housing, good luck—waiting times in Amsterdam stretch up to 15 years.

France isn’t faring much better. Homelessness there has surged dramatically, with 2,043 homeless children registered at the start of the 2024 school year—a 120% increase in just four years. Meanwhile, Germany has been hit hard, with an estimated 531,600 people struggling with homelessness. Of those, 439,500 are stuck in emergency shelters, while 60,400 are couch-surfing with family or friends, hoping something stable comes along.

The problem isn’t just a lack of homes—it’s a brutal combination of skyrocketing rents, stagnant wages, and policy inaction. Cities across Europe have become playgrounds for investors and Airbnb empires, leaving real people scrambling for stability. And unless something changes, this mess isn’t going anywhere.

So… what’s actually causing this catastrophe?

The Seven Deadly Sins of the Housing Crisis

1. Supply and Demand (But Make It Stupid)

The fundamental rule of economics is when demand exceeds supply, prices go up. Simple, right? The problem is that the housing market has been playing a rigged version of this rule.

Why we don’t have enough housing:

- Urbanization – In 1950, only 30% of the world’s population lived in cities. Today, that number is 56%, and it’s still climbing. More people want to live in cities, but cities haven’t kept up.

- Regulations and zoning laws – Many cities have outdated laws that make it absurdly difficult to build new homes. The worst offender? Single-family zoning, which bans apartment buildings in large parts of many cities. In the U.S., 75% of residential land is zoned exclusively for single-family homes.

- Construction costs are sky-high – Labor shortages, material costs, and bureaucratic red tape have all made it ridiculously expensive to build housing.

- NIMBYism (Not In My Backyard) – Local homeowners often fight against new housing developments, fearing their property values will decline. And they usually win.

2. The Financialization of Housing

Housing isn’t just a basic need anymore—it’s a financial asset. Big investors, hedge funds, and even regular landlords have figured out that real estate is one of the safest and most profitable investments out there.

How this screws up the market:

- Corporate landlords – Investment firms like BlackRock have been buying up massive amounts of real estate, driving up prices and making it harder for regular people to compete.

- House flipping culture – Buying cheap homes, renovating them, and reselling at higher prices has turned homes into speculative assets.

- Short-term rentals (Airbnb effect) – Many properties that should be available for long-term renters are now lucrative short-term rentals instead.

3. Low Interest Rates Created a Frenzy

For years, central banks kept interest rates low to stimulate the economy. This had a fun little side effect: borrowing money became cheap, leading to a speculative buying spree in real estate.

- More buyers flooded the market.

- Investors grabbed properties with cheap loans.

- Prices skyrocketed.

- The moment interest rates rose again, many people found themselves trapped in overpriced homes they couldn’t afford.

4. Population Growth and Aging Populations

- More people = more demand. The global population has grown from 2.5 billion in 1950 to 8 billion today.

- Aging populations aren’t selling. Older generations tend to stay in their homes longer, reducing housing turnover. The median age of home sellers in the U.S. has increased from 45 in 1985 to 60 today.

5. The Myth of Trickle-Down Housing

There’s an idea called filtering: If you build high-end housing, rich people will move into it, leaving their old homes for middle-class buyers, who in turn free up cheaper homes. Sounds good. But in reality:

- Luxury apartments stay empty or get turned into investment properties.

- The middle class can’t afford to move up.

- The cheapest homes never get freed up.

6. Wages Have Been Stagnant for Decades

While home values have tripled, wages in many countries have barely nudged. The math just doesn’t work anymore. In the U.S., from 1979 to 2020, worker productivity grew by 61.8%, but wages? They inched up a meager 17.5%.

Over in Europe, it’s no fairy tale either. In the Netherlands, wages have risen by just 15% in the last decade, while house prices have surged by over 80%. In the UK, the average wage has grown by 20% since 2008, but home prices have shot up by 70% in the same period. And in Germany, real wages have remained largely stagnant, while property prices have skyrocketed 60% since 2015.

The result? Millennials and Gen Z find themselves in a bizarre dystopia where they’re expected to work harder than ever, all while being told that homeownership is still totally achievable—if only they stopped buying avocado toast and lattes. The reality? The average person is being financially left in the dust, and the dream of owning a home is quickly shifting from “challenging” to “mathematically impossible.”

7. Disasters Are Shrinking Supply

Mother Nature has decided to join the housing crisis party, and she’s not bringing snacks—just hurricanes, wildfires, and rising sea levels that are wrecking homes faster than we can rebuild them. And it’s not speculation—it’s cold, hard data.

In the U.S., nature related disasters caused a staggering $165 billion in damages in 2022 alone, with Hurricane Ian alone racking up $113 billion in losses. Wildfires in California destroyed over 1,000 homes in 2023, and the increasing frequency of extreme weather events is making some regions nearly uninsurable.

Over in Europe, things aren’t looking much better. In the Netherlands, a country that literally exists because of its battle against water, rising sea levels are putting hundreds of thousands of homes at risk by 2050. Flooding in Germany in 2021 caused €33 billion in damages, forcing many residents to abandon their homes permanently. France and Spain have been dealing with record-breaking wildfires, with over 72,000 hectares burned in France in 2022 alone, destroying thousands of properties.

The real kicker? Insurance companies have caught on. In many high-risk areas, insurance rates are doubling—or worse, providers are just pulling out altogether, leaving homeowners with no safety net. People who once had stable, affordable homes are now facing an impossible choice: stay put and risk losing everything, or move somewhere “safer” (which is usually code for “somewhere much more expensive”).

So, while we’re busy arguing about zoning laws and interest rates, the planet is quietly making sure there’s even lesshousing to go around.

Is There a Way Out of This Mess?

Spoiler: It’s Complicated.

So, what do we do? Just sit back and accept that homeownership is now an exclusive club for the lucky or the already wealthy? Or do we storm the metaphorical Bastille of housing policy and demand change?

The answer is somewhere in the middle, but it’s not going to be easy. The housing crisis is like a multi-headed hydra—you cut off one problem (say, zoning laws), and two more pop up (say, skyrocketing material costs and investment firms buying up homes). But let’s not give up just yet. Here are some ways we might start chipping away at this mess.

1. Loosen Up Zoning Laws

Right now, in many cities, it’s easier to get approval to build a haunted amusement park than it is to build an apartment complex. Zoning laws need to allow for more multi-family units and high-density housing, especially in areas with high demand. Cities like Minneapolis and Tokyo have done this, and—surprise!—it helped keep housing prices in check.

In the Netherlands, where land is scarce and tightly regulated, zoning laws have made urban expansion sluggish. In Amsterdam, over 70% of residential areas are restricted to low-density housing, limiting opportunities to add more homes. Rotterdam has started experimenting with relaxing zoning laws, but broader reforms are needed to prevent housing from turning into a luxury good.

Elsewhere in Europe, places like Vienna have adopted progressive zoning policies that prioritize social housing and high-density developments, helping to maintain affordability. Meanwhile, London and Paris still suffer from restrictive building codes that make new housing projects a bureaucratic nightmare. In Germany, cities like Berlin have recently begun loosening zoning laws to allow for more apartment buildings, a necessary step in combating the 60% rise in housing prices since 2015.

If more governments took a page from cities that have embraced flexible zoning, the housing crisis might start looking less like an inevitable disaster and more like a problem we can actually fix.

2. Tax the Investors Hoarding Homes

If you’re an individual trying to buy a home and losing bidding wars to giant corporations with bottomless pockets, you’re not alone. In cities across the world, investment firms, pension funds, and ultra-wealthy buyers have turned residential properties into an asset class, hoarding homes and pricing regular buyers out of the market. This is especially rampant in global financial hubs like Amsterdam, London, New York, and Berlin, where housing is treated less like a necessity and more like a lucrative investment vehicle.

Governments are finally catching on. In the Netherlands, foreign and corporate investors have snapped up properties at an alarming rate, particularly in Amsterdam and Rotterdam. In response, the Dutch government has introduced a 30% tax on investors buying rental properties, an attempt to curb speculative purchases. Additionally, many municipalities have enacted purchase protection laws preventing buy-to-let investors from buying properties under €355,000, reserving these homes for actual residents.

Other European countries are experimenting with similar strategies. Germany has introduced strict rental controls in cities like Berlin, where a rent cap was temporarily imposed to combat skyrocketing rents driven by investor speculation. France has imposed higher property taxes on second homes, particularly in high-demand cities like Paris, to prevent residential properties from being hoarded as investment vehicles. Meanwhile, Spain has cracked down on Airbnb conversions by banning new short-term rental permits in cities like Barcelona, aiming to keep housing stock available for locals.

The UK, facing one of the most investor-driven housing markets in the world, has also taken steps, with London instituting higher stamp duty rates on corporate and foreign buyers to discourage speculative investment. However, critics argue that these measures are still too lenient and do little to address the structural issues that allow property speculation to flourish.

If governments continue pushing aggressive taxation policies on investors who treat homes like hedge fund assets, regular buyers might finally have a fighting chance. Until then, expect to see more bidding wars where the opponent isn’t another hopeful first-time buyer, but rather a faceless investment firm with an unlimited budget.

3. Incentivize Affordable Construction

Right now, luxury condos pop up like mushrooms after rain, but affordable housing? Not so much. Developers love building high-end apartments because they guarantee higher profits, while affordable housing? Meh. Governments need to make it more attractive—or at least less painful—for developers to build homes that regular people can actually afford.

In the Netherlands, the government has introduced subsidies for affordable housing projects and has started enforcing strict requirements for new developments, mandating that at least 30% of new housing be affordable units. Yet, in cities like Amsterdam, where land prices are sky-high and permits take forever, even these incentives haven’t been enough to keep up with demand.

In Germany, some cities, like Berlin, have adopted an inclusionary zoning model where developers are required to dedicate at least 25% of units in new buildings to affordable housing. However, critics argue that this hasn’t been enough to meet the increasing demand, and private investors are still outpacing public housing initiatives.

Meanwhile, France has experimented with tax incentives and grants for developers who prioritize social housing, and Spain has introduced measures to force developers to allocate a percentage of their projects to affordable units. But the reality is that in most European cities, luxury developments still vastly outnumber affordable ones.

The U.S. has also seen mixed results. Programs like Low-Income Housing Tax Credits (LIHTC) have spurred affordable housing developments, but red tape and profit-driven motives mean that many developers still opt for high-end units. In cities like New York and San Francisco, affordable housing mandates exist, but they are often diluted with loopholes that allow developers to avoid building genuinely affordable units.

If governments want to see more affordable homes being built, they need to shift the playing field: heavier incentives for affordable developments, stricter requirements for developers, and streamlined processes that make it easier—and more profitable—to build housing for the people who actually need it.

4. Improve Public Transit (So People Don’t Have to Live in Big Cities)

A huge part of the housing crisis is that too many people need to live in city centers because commuting from the suburbs is a logistical nightmare. Expanding and improving public transportation would open up more housing options in surrounding areas, easing urban demand.

Take the Netherlands, for example. Amsterdam, Rotterdam, and Utrecht have some of the highest housing costs in the country, but many surrounding towns remain relatively affordable. The problem? Public transport isn’t always reliable or affordable for long commutes. Although the Dutch rail system is generally efficient, train fares have risen by over 20% in the past five years, and overcrowding has become a daily frustration for commuters. Some cities, like Rotterdam, have invested in metro expansions, but there’s still a long way to go in making more distant suburbs truly viable for workers.

Meanwhile, Germany has taken bold steps with its €49-a-month nationwide public transit ticket, making it cheaper for people to live outside expensive city centers like Berlin and Munich while still commuting affordably. France, too, is investing heavily in expanding Paris’s metro and RER lines, aiming to connect outer suburbs more efficiently to the city center. Spain, with its extensive high-speed rail network, has shown that well-planned transit can make smaller cities viable alternatives to expensive metros like Madrid and Barcelona.

Then there’s the U.S., where public transit is either great (if you live in New York or D.C.) or a complete disaster (looking at you, Los Angeles and basically every other major city). The sheer lack of efficient, affordable public transit has locked millions of Americans into living near their workplaces, driving up housing demand in urban centers. Some cities, like Austin and Seattle, are finally investing in mass transit expansions, but for much of the country, suburban living still means owning a car and dealing with soul-crushing commutes.

Ultimately, better public transit is one of the most effective ways to relieve pressure on housing markets. When people can reliably commute from further away, demand for inner-city housing cools down, and prices stabilize. Until then, expect city-center rent prices to keep climbing while commuters suffer in packed trains or endless traffic jams.

A huge part of the housing crisis is that too many people need to live in city centers because commuting from the suburbs is a logistical nightmare. Expanding and improving public transportation would open up more housing options in surrounding areas, easing urban demand.

5. Crack Down on Empty Homes

Imagine an entire neighborhood where the lights are off, no one’s home, but somehow every single unit is “owned”—just not by people actually living in them. That’s the reality in many cities where speculative investors, foreign buyers, and short-term rental businesses have turned homes into ghost assets.

In Amsterdam, around 6% of homes are estimated to be vacant due to speculative ownership, with many properties sitting empty as their value appreciates. In response, the Dutch government has introduced the Vacancy Tax, aiming to push empty properties back into the housing market. Additionally, Amsterdam has banned new short-term rental licenses in certain areas to prevent apartments from being converted into year-round Airbnbs, which have significantly reduced rental availability for locals.

Meanwhile, Berlin has gone even further by strictly regulating short-term rentals and enforcing hefty fines on landlords who keep properties vacant for speculative reasons. France, facing a similar problem in cities like Paris and Lyon, has increased taxes on vacant homes by 60% in high-demand areas and has cracked down on foreign investors treating housing as a financial asset rather than a place to live.

In the U.S., major cities like San Francisco and New York have introduced anti-speculation measures, such as increased property taxes on unoccupied units and stricter short-term rental regulations. New York has passed laws requiring short-term rental hosts to be primary residents, making it harder for corporate landlords to dominate the rental market.

The result? A mixed bag. While vacancy taxes and short-term rental bans have helped push some properties back into circulation, enforcement remains a challenge. Investors find loopholes, and enforcement agencies often lack the resources to track down every empty unit. But as cities tighten regulations and put the pressure on property hoarders, more homes might actually go back to serving their intended purpose: housing people, not profit margins.

6. Stop Treating Housing Like the Stock Market

Somewhere along the way, we collectively forgot that housing is meant for living in, not for betting on. Instead of being places where families grow and communities form, homes have become financial assets—traded, flipped, and hoarded by investors looking for the next big payday.

Let’s talk about the Netherlands. Amsterdam has become one of Europe’s most speculative housing markets, with an estimated 30% of home purchases made by investors before the government stepped in with regulations. The Dutch government has since introduced purchase protection laws, limiting investor activity in the housing market, and increased taxes on landlords to discourage buy-to-let speculation. Yet, despite these efforts, house prices remain high, and many middle-class families are still being outbid by investment firms and pension funds looking to park their cash in real estate.

Over in Germany, Berlin has experimented with radical measures, including a temporary rent freeze and attempts to expropriate large corporate landlords like Vonovia and Deutsche Wohnen. The push to return housing to the people even led to a referendum where 56.4% of Berliners voted in favor of confiscating investor-owned apartments—though the government has been hesitant to act on the results. Meanwhile, Munich and Hamburg have implemented stricter rules for real estate investors to limit property speculation.

France has taken a different approach by taxing second homes more aggressively, particularly in cities like Paris, where wealthy investors have been driving up prices in central districts. Similarly, Spain has cracked down on real estate speculation by imposing restrictions on short-term rental licenses in cities like Barcelona, aiming to prevent entire neighborhoods from being transformed into Airbnb empires.

And in the United States, real estate speculation has reached absurd levels. In cities like New York, San Francisco, and Austin, corporate landlords have gobbled up single-family homes, squeezing out first-time buyers. As of 2023, investor purchases accounted for nearly 25% of all home sales in the U.S., with Wall Street-backed firms buying up entire neighborhoods to convert them into high-rent properties. Some states have begun pushing back, with California introducing stricter rent control laws and New York placing limits on short-term rental conversions.

Meanwhile, there are places that have actually done something about this—like Vienna, where over 60% of residentslive in government-supported housing. Vienna treats housing as a public good rather than an investment opportunity, ensuring affordability across all income levels. This model has kept rent prices relatively stable, proving that when cities prioritize people over profits, things tend to work a lot better.

If more governments followed Vienna’s lead—regulating speculative purchases, expanding public housing, and imposing meaningful taxes on property speculation—we might just be able to shift housing back to what it was meant to be: a place to live, not just another line in an investor’s portfolio.

Will Any of This Happen?

Well… maybe. The biggest obstacle isn’t that we don’t have solutions—it’s that most of these solutions require people who already own homes (and vote in large numbers) to accept changes that might lower their property values. That’s a tough sell.

But here’s the thing: cities that have tackled their housing crises head-on—like Singapore, Tokyo, and Vienna—have shown that it is possible. It just takes the right mix of political will, policy shifts, and people demanding change.

So, while we may not wake up tomorrow to a world where buying a home or reting one doesn’t require selling a kidney, we’re not completely doomed. At least, not yet.